What is IRS form W-4?

IRS form W-4

The IRS form W-4 (or "Employee's Withholding Certificate") tells an employer how much to withhold from an employee's paycheck for federal taxes—a critical piece of a tax system where compliance costs are estimated to be 10 percent of tax revenue collected.

Because each taxpayer's personal circumstances differ, tax obligations vary from employee to employee. As a result, employers won't know how much to withhold from each employee's paycheck unless the employees tell them. The W-4 is how employees let their employer know what amount to withhold.

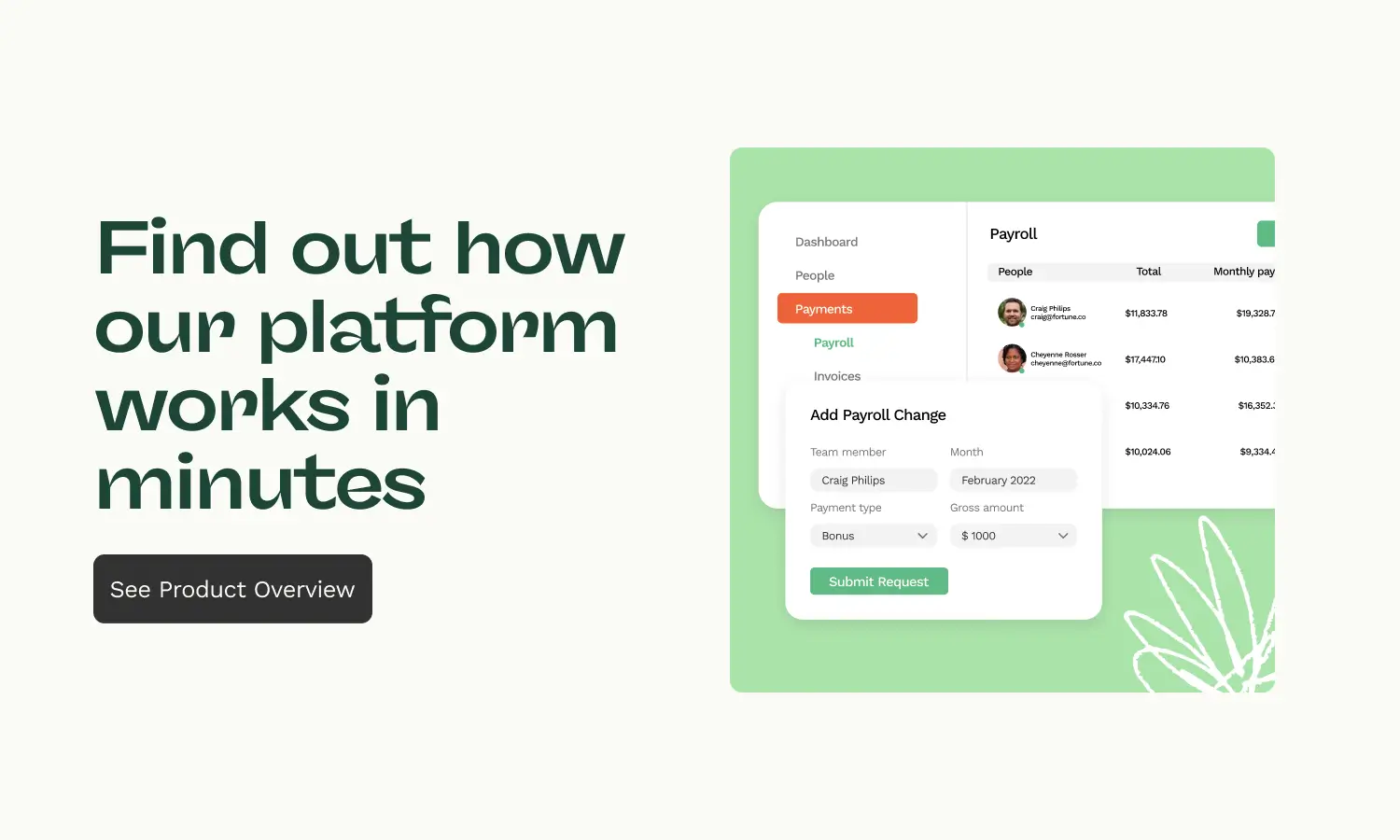

Interested in Oyster but want more information about how the platform works? This product overview should help.

What is a W-4 form used for?

So, what exactly is a W-4 form used for? It tells your employer how much federal income tax to withhold from each paycheck. Get it right, and you'll avoid surprise tax bills or overpaying the IRS throughout the year.

The form helps your employer calculate the correct withholding amount based on:

- Your filing status (single, married, etc.)

- Total household income

- Number of dependents you'll claim

- Deductions and credits you expect to take

When do you have to complete a W-4?

You must complete a W-4 whenever you start a new job. But it's not a one-and-done deal—you should update it when your situation changes.

Here's when you'll want to submit a new W-4:

- New job: Required for all new employers

- Life changes: Marriage, divorce, or new dependents

- Income changes: Salary increases, bonuses, or side income

- Tax strategy shifts: Want to adjust your refund or tax bill

Skip the update, and you might face a surprise tax bill or give the government an interest-free loan; such mistakes contribute to a system where reducing the number of errors in tax filings could save the IRS millions annually.

What information does a W-4 require?

What information does the W-4 actually ask for? More than just your name and address—it needs details that affect your tax withholding.

You'll provide information about:

- Personal details: Name, address, Social Security number

- Filing status: Single, married filing jointly, etc.

- Multiple jobs: Whether you or your spouse work elsewhere

- Dependents: Children and other qualifying dependents

- Other income: Investment returns, side jobs, spouse's income

- Deductions: Beyond the standard deduction, which is taken by about two-thirds of taxpayers who do not itemize

- Extra withholding: Additional amount you want withheld

How do you fill out a W-4 tax form?

Completing a W-4 requires some calculations relating to income, deductions, and personal circumstances, which is part of a larger tax system that can take taxpayers more than thirteen and one-half hours to complete for a full 1040 form.

- Marital status

- If this is a joint return with a spouse

- Deductions claimed

- Additional tax withheld

Fortunately, the IRS provides instructions with the form on how to fill it out properly. There are also worksheets included in the form to help with calculations, along with the IRS's handy tax withholding estimator.

Managing tax compliance for global teams

For businesses with distributed teams, managing tax compliance across different countries adds another layer of complexity, especially when compared to systems in countries like Denmark and Sweden, where a majority of tax returns prepared by the government simplify the process for individuals. While the W-4 is specific to U.S. federal taxes, every country has its own set of forms and regulations for employee tax withholding. Ensuring every team member is set up correctly requires local expertise and a streamlined process.

A global employment platform simplifies this by handling country-specific tax documentation and payroll compliance, so you can focus on building your team without getting lost in administrative tasks. With Oyster, you can start hiring globally while we handle the local compliance.

FAQ

What's the difference between a W-2 and a W-4?

A W-4 tells your employer how much tax to withhold from your pay when you start a job. A W-2 is the year-end summary of your earnings and withheld taxes that you use to file your tax return.

Is it better to put 0 or 1 on my W-4?

The current W-4 (updated in 2020) doesn't use allowances anymore—it uses dollar amounts instead. To have more tax withheld, enter an extra amount in Step 4(c).

What happens if I don't update my W-4 when my situation changes?

You could face a surprise tax bill (and penalties) if you under-withhold, or give the government an interest-free loan if you over-withhold. Update your W-4 whenever your situation changes to avoid both problems.

Disclaimer: This article and all information in it is provided for general informational purposes only. It does not, and is not intended to, constitute legal or tax advice. You should consult with a qualified legal or tax professional for advice regarding any legal or tax matter and prior to acting (or refraining from acting) on the basis of any information provided on this website.

About Oyster

Oyster is a global employment platform designed to enable visionary HR leaders to find, hire, pay, manage, develop, and take care of a thriving distributed workforce. Oyster lets growing companies give valued international team members the experience they deserve, without the usual headaches and expense.

Oyster enables hiring anywhere in the world—with reliable, compliant payroll, and great local benefits and perks.

Related Resources

.avif)

.avif)

.avif)

_Leader_Leader%201%20(2)%20(3).svg)

_Leader_UnitedKingdom_Leader%201%20(1).svg)

_Leader_Europe_Leader%201%20(1).svg)

_Leader_Mid-Market_Leader%201%20(1).svg)

_Leader_Small-Business_Europe_Leader%202%20(2).svg)

_Leader_Small-Business_Leader%201%20(1).svg)

_FastestImplementation_Small-Business_GoLiveTime%201%20(1)%20(1).svg)